Trend Analysis columns

Trend Analysis columns – daily, weekly, monthly, quarterly, and yearly

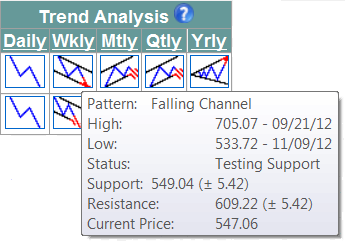

trends details are presented by trend alert icons. An icon indicates trend pattern

and status (valid, testing trend support, testing trend resistance, broken

trend support, broken trend resistance).

Tips: – To see detailed trend analysis

information, place the cursor over an icon. A tool tip popup window will come up.

– Click on the icon to see detailed trend analysis information in a separate

popup window.

– Click on the column header to sort records in ascending/descending order (subscribers only).

|